IN ST-105D 2005-2025 free printable template

Show details

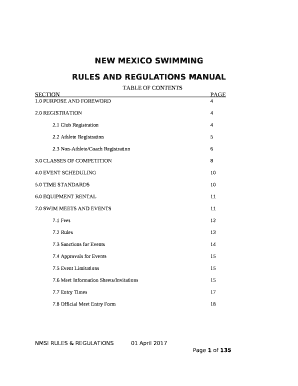

Form ST-105D State Form 51520 R2/ 5-05 Indiana Department of Revenue Resale Certificate of Exemption Sales to a Licensed Vehicle Trailer or Watercraft Dealer Only by an Indiana Automobile Auction or an Indiana Licensed Dealer This form is to be used only by an Indiana automobile auction or an Indiana dealer to reflect sales of motor vehicles trailers or watercraft sold exempt from Indiana sales tax for purposes of the resale exemption per I. C. 6-2. 5-5-8. The purchasers claiming the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax exempt form indiana

Edit your st 105d indiana form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 105d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana resale certificate online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indiana tax exempt form 2025. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

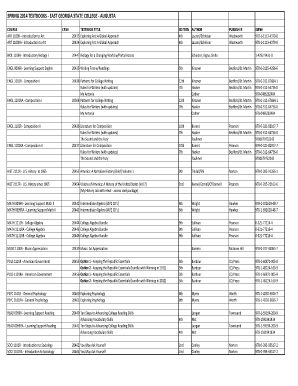

IN ST-105D Form Versions

Version

Form Popularity

Fillable & printabley

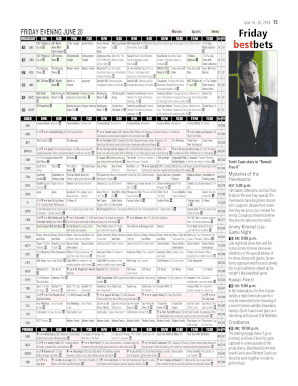

How to fill out st105d form

How to fill out IN ST-105D

01

Begin by obtaining the IN ST-105D form from the appropriate tax authority website or office.

02

Fill in the taxpayer's name, address, and identification number at the top of the form.

03

Specify the type of exemption you are claiming in the designated section.

04

Include relevant details regarding the items or services for which the exemption is being requested.

05

Review all the information for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed IN ST-105D form to the appropriate state tax office.

Who needs IN ST-105D?

01

Businesses and organizations that are claiming exemption from sales tax in Indiana.

02

Non-profit organizations that qualify for tax-exempt purchases.

03

Educational institutions seeking tax-exempt status for certain purchases.

Fill

who is required to file being purchased under the exemption

: Try Risk Free

People Also Ask about indiana tax exempt certificate

What is an Indiana ST 105 form?

Indiana Form ST-105, General Sales Tax Exemption Certificate.

How do I get sales tax exemption in Indiana?

In order for a purchase to be exempt from Indiana sales tax, a Nonprofit Sales Tax Exemption Certificate (NP-1) must be requested by the Tax Department through the Indiana Department of Revenue (DOR) online portal. The NP-1 issued by the Indiana DOR is unique to each vendor and includes an expiration date.

Does Indiana have a sales tax exemption certificate?

In order to claim an exemption from sales tax on purchases in IN, a completed Indiana General Sales Tax Exemption Certificate (ST-105), as attached below, must be presented to the vendor at the time of purchase. Please be sure to fill in the description of items to be purchased in Section 2 before signing in Section 4.

What is Indiana tax exempt form resale?

An Indiana resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

How do I get a sales tax exemption certificate in Indiana?

In order for a purchase to be exempt from Indiana sales tax, a Nonprofit Sales Tax Exemption Certificate (NP-1) must be requested by the Tax Department through the Indiana Department of Revenue (DOR) online portal. The NP-1 issued by the Indiana DOR is unique to each vendor and includes an expiration date.

What qualifies for sales tax exemption in Indiana?

While the Indiana sales tax of 7% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Indiana.Other tax-exempt items in Indiana. CategoryExemption StatusFood and MealsMachineryEXEMPTRaw MaterialsEXEMPTUtilities & FuelEXEMPT19 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find st 105 indiana 2025?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific indiana tax exemption form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my form st 105 indiana in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your st 105 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out st 105 form on an Android device?

Complete your indiana tax exempt form pdf and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IN ST-105D?

IN ST-105D is a form used in Indiana for tax exemption purposes, specifically for claiming exemptions related to sales tax.

Who is required to file IN ST-105D?

Any organization or individual that qualifies for a sales tax exemption in Indiana is required to file IN ST-105D.

How to fill out IN ST-105D?

To fill out IN ST-105D, you must provide your name, address, the reason for the exemption, and any other required details regarding the transactions.

What is the purpose of IN ST-105D?

The purpose of IN ST-105D is to allow eligible entities to claim sales tax exemptions on purchases made for qualified purposes.

What information must be reported on IN ST-105D?

The information that must be reported on IN ST-105D includes the purchaser's name, address, type of exemption being claimed, and detailed descriptions of the items or services being purchased under the exemption.

Fill out your IN ST-105D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Form st105 is not the form you're looking for?Search for another form here.

Keywords relevant to st 105 indiana

Related to indiana st 105 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.